Client Alert: Good News for PPP Borrowers (of $50,000 or Less)

Date: October 9, 2020

By:

Jordan M. Halle

This new application requires fewer calculations and less documentation for eligible borrowers, because PPP borrowers that use Form 3508S are exempt from reductions in loan forgiveness amounts based on reductions in full-time equivalent employees or in salaries or wages. Form 3508S also does not require PPP borrowers to show the calculations used to determine their loan forgiveness amount.

So, PPP borrowers still must do the calculation to determine their total loan forgiveness amount (without reductions), but they do not need to show their work.

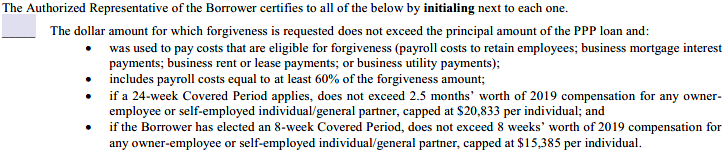

In exchange for this brevity, PPP borrowers must make increased representations if using Form 3508S:

And, be warned, SBA may request information and documents to review those calculations as part of its loan review process.

Borrowers are also still required to submit supporting documentation to their PPP lenders consisting of (i) documentation verifying the eligible cash compensation and non-cash benefit payments from the Covered Period or the Alternative Payroll Covered Period and (ii) documentation verifying existence of the obligations/services prior to February 15, 2020, and eligible payments from the Covered Period.

As a companion to the Form 3508S, SBA also posted an Interim Final Rule that reflect the substance of the above, and addresses additional PPP lender responsibilities to review PPP borrower documentation, particularly for Form 3508S. Here, SBA instructs PPP lenders reviewing Form 3508S submissions to “confirm receipt of the borrower certifications” and “confirm receipt of the documentation the borrower must submit.” Otherwise, a PPP lender may rely on the PPP borrower’s representations regarding their calculations, which the PPP lender does not need to verify or confirm.

This is not the “automatic forgiveness” that small business and banking interest groups have been lobbying for, which would require an act of Congress to grant. This will be a welcome relief for the over 3.5 million small borrowers (who represent about 68% of all borrowers), but is a disappointment to the nearly one million borrowers in the $50,000 to $150,000 range. Given the state of affairs in Congress, hope for automatic forgiveness legislation is dwindling.