Client Alert: Key Changes To The Paycheck Protection Program

Date: June 9, 2020

By:

Jordan M. Halle

Many small business owners and other recipients of PPP loans have vocalized their difficulty in planning to meet the original requirement that, to be eligible for forgiveness, they must use their PPP loan proceeds within the 8-week covered period following their loan origination date. The Flexibility Act addresses this issue by extending the “covered period” to the earlier of 24 weeks from loan disbursement or December 31, 2020. A borrower who received a loan before the bill’s enactment could elect to continue using the eight-week covered period. At this time, it is unclear how a borrower would make such an election or whether a borrower could submit a forgiveness application earlier than the end of the extended 24-week covered period.

Similarly, the Flexibility Act also addresses the 75/25 rule adopted by the Small Business Administration in its initial round of Interim Final Rules, under which PPP borrowers previously must have spent at least 75 percent of their PPP loan proceeds on Payroll Costs and no more than 25 percent on allowable non-Payroll Costs. Instead, under the Flexibility Act, at least 60% of the covered loan amount must be used for Payroll Costs, and up to 40% can be used for interest on covered mortgage obligations, any payment of any covered rent obligation, or any covered utility payment. As written, this 60% requirement appeared to be a “cliff,” meaning that for a PPP borrower to be eligible for any forgiveness, they must spend at least 60% of their PPP funds on Payroll Costs. However, on June 8, 2020, Treasury Secretary Steven Mnuchin and SBA Administrator Jovita Carranza announced in a joint statement that the Flexibility Act will not be interpreted as a cliff. Rather, if a borrower uses less than 60 percent of the loan amount for payroll costs during the forgiveness covered period, the borrower will continue to be eligible for partial loan forgiveness, subject to at least 60 percent of the loan forgiveness amount having been used for payroll costs.

Under the CARES Act, borrowers had until June 30, 2020, to restore their number of full time equivalent employees and reverse any salary cuts of greater than 25%, or face a reduction in their loan forgiveness. In light of the widespread concern of continued state and local shutdowns, the Flexibility Act extends that deadline until December 31, 2020.

Further, the Flexibility Act exempts borrowers from a reduction in loan forgiveness due to a reduced number of full time equivalent employees if the borrower, in good faith, is able to document either:

- An inability to rehire individuals who were employees of the borrower on February 15, 2020, and an inability to hire similarly qualified employees for unfilled positions on or before December 31, 2020; or

- An inability to return to the same level of business activity as before February 15, 2020, due to compliance with federal requirements or guidance set forth between March 1 and December 31, 2020, relating to standards of sanitation, social distancing, or other worker or customer safety requirements related to COVID-19.

The SBA, under the CARES Act, imposed a two-year maturity date for PPP Loans. The Flexibility Act extends the minimum loan term to five years. This change applies to any PPP loan made on or after the Effective Date, but Congress, in the Flexibility Act, made clear that lenders and borrowers are not prohibited from mutually agreeing to modify the maturity terms of prior-disbursed PPP loans.

Finally, the Flexibility Act removes the CARES Act provision restricting employers who receive PPP loan forgiveness from deferring payroll taxes incurred between March 27, 2020 and December 31, 2020.

One thing that did not change, as Senate leader Mitch McConnell clarified in a letter added to the Congressional Record, is that the deadline for applying for a PPP loan remains June 30, 2020. According to Sen. McConnell’s letter, the extended covered period (as that term is used with respect to the use of PPP funds rather than the covered period for purposes of PPP loan forgiveness) pertains solely to an extension of the period for the use of PPP funds, from June 30, 2020 to December 31, 2020.

The SBA will need to revise their Paycheck Protection Program Forgiveness Application to account for the changes enacted by Congress in the Flexibility Act and we expect a similar flurry of new Interim Final Rules and Frequently Asked Questions to address these changes.

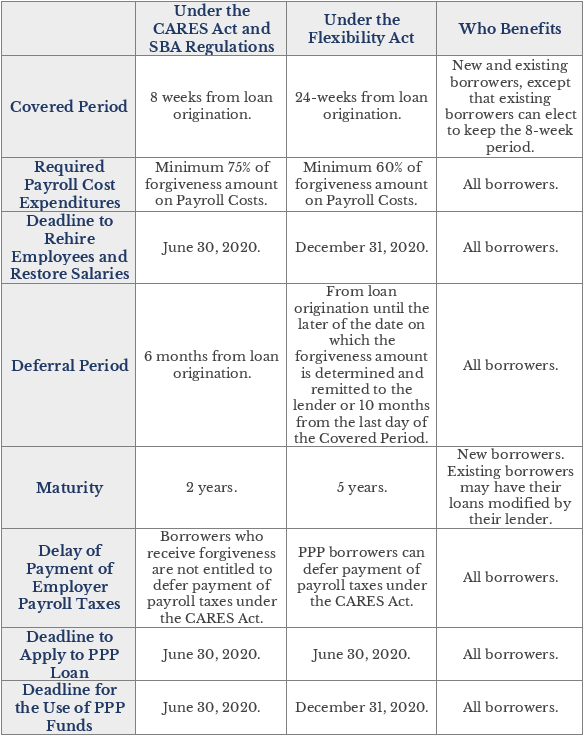

Summary Chart of Changes from the CARES Act to the Flexibility Act

The information contained here is not intended to provide legal advice or opinion and should not be acted upon without consulting an attorney. Counsel should not be selected based on advertising materials, and we recommend that you conduct further investigation when seeking legal representation.